Huawei's $B 5G chipset delivers a "peak" of 2.0 gig download at 3.5 GHz; Qualcomm's Snapdragon X24 LTE 4G "peaks" at 2 Gig.

"Who needs fiber?" everyone was asking. Grahame Lynch predicted three years ago that wireless would be fast enough that the fiber broadband network was unnecessary. It's not that simple, but the new wireless certainly will be enough for many.

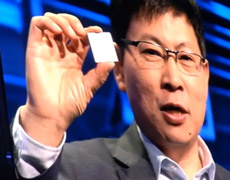

The $B Balong 5G01 is a remarkable achievement and big news. The release is below: It's a mainstream, 3GPP standard chip that's very similar to the advanced chips of leaders Qualcomm, Intel, and Apple. The processor cores are ARM. They showed off working routers for both < 6 GHz and mmWave. There are different chips for the two frequency ranges. These are first generation chips; second generation, due later in 2018, will be smaller. They expect routers for sale this year and phones in 2019.

The $B Balong 5G01 is a remarkable achievement and big news. The release is below: It's a mainstream, 3GPP standard chip that's very similar to the advanced chips of leaders Qualcomm, Intel, and Apple. The processor cores are ARM. They showed off working routers for both < 6 GHz and mmWave. There are different chips for the two frequency ranges. These are first generation chips; second generation, due later in 2018, will be smaller. They expect routers for sale this year and phones in 2019.

Most tech specs are not yet released, including how much spectrum is needed for 2 gigabits; power consumption; heat generation; and practical latency.

That development of this chip is costing $B is my estimate, based on how many engineers are needed for 5G chips and the costs of the necessary 7 nm chip production. TSMC is probably producing this chip (and Apple's.) Intel and Samsung may be the only other fabs in the world capable of the level of complexity. Both have their own 5G chips on the way. 7 nanometers is getting close to atomic sizes.

Contrary to rumor, Moore's Law isn't dead yet. 5 nm and probably 3 nm chips are coming in the next few years but they won't be cheap. Both TSMC and Samsung are spending $20B on single plants.

There's a race between 6 companies to actually deliver 5G chips. Intel, Qualcomm, and now Huawei promise chips in 2018 for routers. They may be too hot and power hungry for phones, and the analog front end for phones may not be ready for 2018. Apple, Samsung, and MediaTek are spending very heavily to stay in the race. Their marketing departments are competing almost as hard making claims.

Don't believe anything until you see it working in the field 10,000 times.

Huawei Releases First 5G Customer-premises Equipment

Breakthrough device sets the stage for the future of mobile connectivity

[Barcelona, Spain, February 25, 2018] Today at Mobile World Congress, Huawei Consumer Business Group (CBG) launched its HUAWEI 5G customer-premises equipment (CPE), the world’s first commercial terminal device supporting the globally recognized 3GPP telecommunication standard for 5G. This device marks a milestone as Huawei sets the stage for the next generation of wireless connectivity.

To ensure peak performance from its 5G CPE, Huawei uses its self-developed Balong 5G01 chipset – the world’s first commercial chipset supporting the 3GPP standard for 5G, with theoretical downlink speeds of up to 2.3Gbps. It supports 5G across all frequency bands including sub-6GHz and millimeter wave (mmWave) to offer a complete 5G solution suitable for multiple use cases. The Balong 5G01 makes Huawei the first company offering an end-to-end 5G solution through its network, devices and chipset-level capabilities.

“5G technology will underpin the next leap forward for our intelligent world, where people, vehicles, homes and devices are fully connected, delivering new experiences, insights and capabilities,” said Richard Yu, CEO of Huawei Consumer Business Group. “Since 2009, Huawei has invested US$600 million in research and development into 5G technologies, where we have led the way with innovations around network architecture, spectrum usage, field verification and more. From connected vehicles and smart homes to AR/VR and hologram videos, we are committed to developing a mature 5G ecosystem so that consumers can benefit from a truly connected world that transforms the way we communicate and share.”

The HUAWEI 5G CPE has two models, low frequency (sub6GHz) 5G CPE and high frequency (mmWave) 5G CPE respectively. The HUAWEI low frequency 5G CPE is small and lightweight, compatible with 4G and 5G networks, and has proven measured download speeds of up to 2Gbps – 20 times that of 100Mbps fiber. This provides an ultra-fast experience, allowing users to enjoy VR video and gaming experiences, or download a TV show within a second. The HUAWEI high frequency 5G CPE is available in indoor and outdoor units.

5G networks set new standards for high speed, wide bandwidth, low latency wireless connections, with a peak downlink rate of 20Gbps, support for one million devices per square kilometer and latency as low as 0.5ms. 5G promises an enhanced connection between people and the Internet of Things, raising the potential for the number of devices that can be connected and the amount and type of data that can be shared between them.

Huawei CBG has developed a 5G device strategy which utilizes the high-speed, low-latency, big-connectivity qualities of 5G to create richer, more varied connected experiences for users. This strategy includes smartphones, mobile Wi-Fi, industrial modules and other devices to connect people and objects in their homes, vehicles and beyond.

Huawei has partnered with over 30 global telecommunication carriers, including Vodafone, Softbank, T-Mobile, BT, Telefonica, China Mobile and China Telecom. In 2017, Huawei began testing 5G commercial networks with partners. Huawei completed interoperability testing and started offering the first round of 5G commercial networks in 2018.